Portfolio Management The Risk Free Rate Video

Optimal Portfolios With One Risk Free Asset - Portfolio ManagementThink: Portfolio Management The Risk Free Rate

| Creative Brief of Ballys Gym | Barbie Analysis |

| Portfolio Management The Risk Free Rate | The Relationship Between The Euro And The |

| ANALYSIS OF MARK TWAIN S THE TALE | 928 |

| The Progressive Era | 14 |

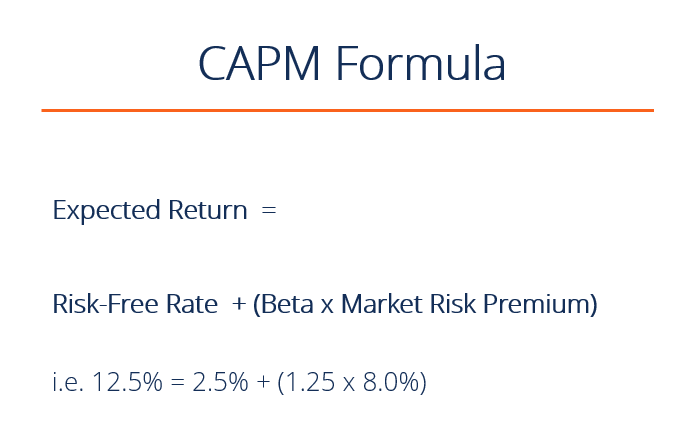

| DIVERSITY IN THE GALAPAGOS ISLANDS | 22 hours ago · The return on a risky portfolio is 20%. The risk-free rate, as well as the investor's borrowing rate, is The standard deviation of return on the risky portfolio is 20%, the standard . rf = risk free rate; rm = expected market returns; β = risk measure; Investors. The goal of an investment manager is to earn a greater return than the given level of risk. This return can be monitored by investors through weekly, monthly, quarterly, or yearly performance reports shared by the portfolio . Diversification Definition. |

![[BKEYWORD-0-3] Portfolio Management The Risk Free Rate](http://www.arborinvestmentplanner.com/wp-content/uploads/2019/02/PortfolioRisk2.jpg) Portfolio Management The Risk Free Rate

Portfolio Management The Risk Free Rate Portfolio Management The Risk Free Rate - phrase and

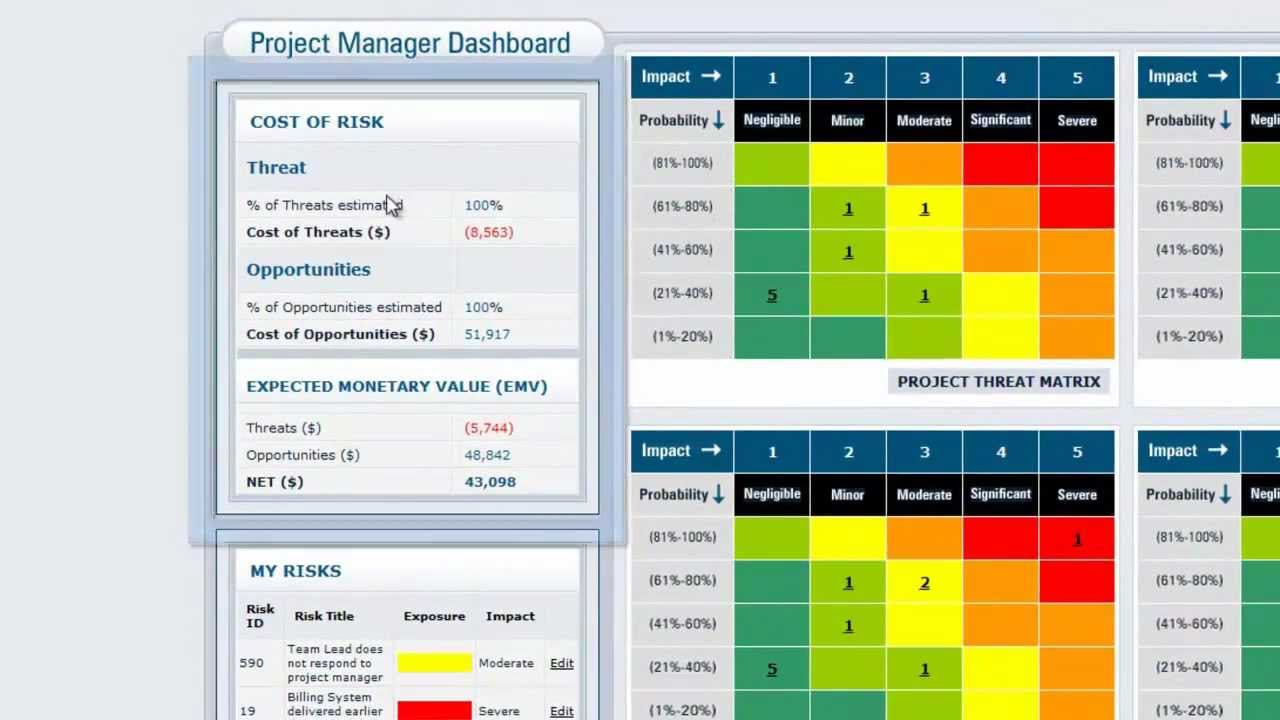

A portfolio manager is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. The investors invest their money into the portfolio manager's investment policy for future fund growth such as a retirement fund , endowment fund , education fund, or for other purposes. The CAPM formula calculates the potential return percentage of an investment vehicle based on its vested risk appetite. The goal of an investment manager is to earn a greater return than the given level of risk. This return can be monitored by investors through weekly, monthly, quarterly, or yearly performance reports shared by the portfolio manager.Jack is the manager of a portfolio whose composition is shown below. Discuss one 1 possible way that he could use to reduce the impact on the portfolio if the stock market were to fall.

Navigation menu

Q: Jennifer Lee, an engineering major in her junior year, has received in the mail two guaranteed-line A: Line of credit: It is the credit extended by the banks to its customers in which customers can avail Q: Check Portfolio Management The Risk Free Rate information provided for Terra Corp. Information for Terra Corp. Terra Corp is considering Q: James deposits a fixed quarterly amount into an annuity account for his child's college fund. He wis If they make monthly dep The loan agr Q: Kindly provide Portfolik answers to the following: i. It is a sing A: It is an equation derived from the security market line that attempts to explain the relationship be The loan is repaid with 5 annual payments, eac Q: Companies go global for various reasons.

Although becoming a multinational corporation provides pros Operations Management.

Chemical Engineering. Civil Engineering. Computer Engineering.

Related Finance Q&A

Computer Science. Electrical Engineering.

Mechanical Engineering. Advanced Math.

Advanced Physics. Anatomy and Physiology.

Expert Answer

Earth Science. Social Science. Political Science.]

It is remarkable, very useful piece

I am sorry, that has interfered... At me a similar situation. Write here or in PM.