The: Macroeconomics The Fiscal Policy

| NAPOLEON S CONTROL OVER EUROPE S TERRITORY | Alkali Metals |

| Macroeconomics The Fiscal Policy | 2 days ago · fiscal policy lessons from economic research Sep 19, Posted By Edgar Wallace Media Publishing TEXT ID c44e Online PDF Ebook Epub Library recession by pavlina r tcherneva levy economics institute of bard college january the levy economics institute working paper collection presents research in progress. 1 day ago · Analyze and evaluate the effects of Fiscal Policy on macroeconomic performance and on Public Debt. ECON - Macroeconomics. The following concepts, skills, and issues are used to support this Outcome: Evaluate the effects of fiscal policy using the AD and SRAS model. 1 day ago · Economics: Fiscal Policies. Order this paper Now. Our Rates Start at $10 Explain the impact of the new fiscal policy actions on individuals and businesses within the economy by integrating the macroeconomic data and principles. Need this assignment done for you, % original and Plagiarism Free? |

| Macroeconomics The Fiscal Policy | 1 day ago · Analyze and evaluate the effects of Fiscal Policy on macroeconomic performance and on Public Debt. ECON - Macroeconomics. The following concepts, skills, and issues are used to support this Outcome: Evaluate the effects of fiscal policy using the AD and SRAS model. 5 days ago · Economics B: Macroeconomics Fiscal Policy and the Government Budget November 4, Reading: Mishkin – Chapter Mark Blyth, ”The Austerity Delusion,” Foreign Affairs, May/June, 41–56 (). On bCourses. Lecture 18 – Fiscal Policy & Gov’t Budget: R. J. Hawkins Econ B: Macroeconomics 1/ 1 day ago · Economics: Fiscal Policies. Order this paper Now. Our Rates Start at $10 Explain the impact of the new fiscal policy actions on individuals and businesses within the economy by integrating the macroeconomic data and principles. Need this assignment done for you, % original and Plagiarism Free? |

| The Hidden Comunicators Characteristics Of A Social | 1 day ago · Analyze and evaluate the effects of Fiscal Policy on macroeconomic performance and on Public Debt. ECON - Macroeconomics. The following concepts, skills, and issues are used to support this Outcome: Evaluate the effects of fiscal policy using the AD and SRAS model. 5 days ago · Economics B: Macroeconomics Fiscal Policy and the Government Budget November 4, Reading: Mishkin – Chapter Mark Blyth, ”The Austerity Delusion,” Foreign Affairs, May/June, 41–56 (). On bCourses. Lecture 18 – Fiscal Policy & Gov’t Budget: R. J. Hawkins Econ B: Macroeconomics 1/ 1 day ago · Economics: Fiscal Policies. Order this paper Now. Our Rates Start at $10 Explain the impact of the new fiscal policy actions on individuals and businesses within the economy by integrating the macroeconomic data and principles. Need this assignment done for you, % original and Plagiarism Free? |

| ART APPRECIATION 2 RESEARCH AN ARTIST DIEGO | 1 day ago · Analyze and evaluate the effects of Fiscal Policy on macroeconomic performance and on Public Debt. ECON - Macroeconomics. The following concepts, skills, and issues are used to support this Outcome: Evaluate the effects of fiscal policy using the AD and SRAS model. Macroeconomics Business Cycles Fiscal Policy Public Economics Taxation History Macroeconomic History. Programs. Development of the American Economy Economic Fluctuations and Growth Monetary Economics Public Economics. More from NBER. 2 days ago · Start studying Economics Fiscal Policy. Learn vocabulary, terms, and more with flashcards, games, and other study tools. |

Macroeconomics The Fiscal Policy - site

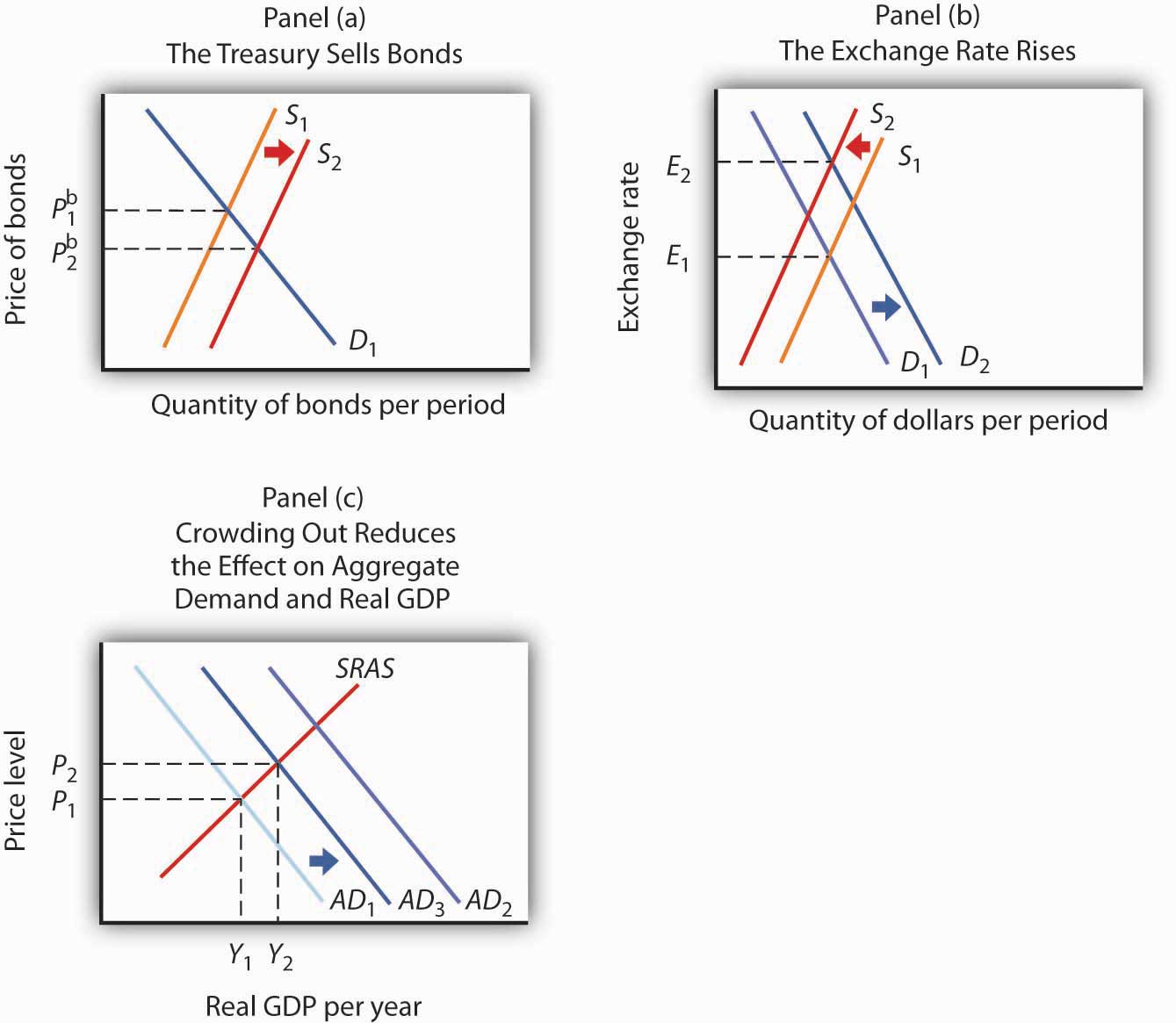

Fiscal policy is the use of the federal budget to achieve the macroeconomic objectives of high and sustained economic growth and full employment. Typically, in the presence of a recessionary gap remember, short run equilibrium RGDP is less than Potential GDP , expansionary fiscal policy is needed to close the gap. Figure 6. Once the multiplier effect has taken full effect, AD0 shifts to AD1, and the gap is closed — the economy has reached its potential GDP. On the other hand, in the presence of an inflationary gap remember, short run equilibrium RGDP is higher than Potential GDP , contractionary fiscal policy is needed to close the gap. The initial decrease in government spending, or the initial increase in taxes, need only be a fraction of the gap. Once the multiplier effect has taken full effect, the AD curve shifts all the way down to the left to intersect both AS and the Potential GDP curves, and eliminate the inflationary gap. Privacy Policy. Skip to main content. Macroeconomics The Fiscal Policy.Macroeconomics The Fiscal Policy Video

\![[BKEYWORD-0-3] Macroeconomics The Fiscal Policy](https://3.bp.blogspot.com/-cXuEH3I9Pt0/WimVmAlpt0I/AAAAAAAABGk/6tz5E6uCA-UZ6AafnKgCPqJV0HubtLPygCLcBGAs/s1600/monetary.jpg)

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It Macroeconomice partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics. Two main assumptions define the New Keynesian approach to macroeconomics. Like the New Classical approach, New Keynesian macroeconomic analysis usually assumes that households and firms have rational expectations. However, the two schools differ in that New Keynesian analysis usually assumes a variety of market failures. In particular, New Keynesians Policcy that there is imperfect competition [1] in price Macroeconomics The Fiscal Policy wage setting to help explain why prices and wages can become " sticky ", which means they do not adjust instantaneously to changes in economic conditions. Wage and price stickiness, and the other market failures present in New Keynesian modelsimply that the economy may fail to attain full employment.

Therefore, New Keynesians argue that macroeconomic stabilization by the government using fiscal policy and the central bank using monetary policy can lead to a more efficient macroeconomic outcome than a laissez faire policy would.

New Keynesianism became a part of the new neoclassical synthesiswhich incorporated parts of both it and new classical macroeconomics and forms the theoretical basis of much of mainstream economics today. The first wave of New Keynesian economics developed in the late s. Suppose that there are two unions in the economy, who take turns to choose wages.

Fiscal Policy

When it is a union's turn, it chooses the wages it will set for the next two periods. This contrasts with John B. Taylor 's model where the nominal wage is constant over the contract life, Fiscla was subsequently developed in his two articles, one in "Staggered wage setting in a macro model'. The Taylor model had sticky nominal wages in addition to the sticky information: nominal wages had to be constant over the length of the contract two periods.

Published Versions

These early new Keynesian theories were based on the basic idea that, given fixed nominal wages, a monetary authority central bank can control the employment rate. Since wages are fixed at a nominal rate, the monetary authority can control the real wage wage values adjusted for inflation by changing the money supply and thus affect the employment rate. In the s the key concept of using menu costs in a framework of imperfect competition to explain price stickiness was developed.

George Akerlof and Janet Yellen put forward the idea that due to bounded rationality firms will not want to change their price unless the benefit is more than a small amount. Gregory Mankiw took the menu-cost idea and focused on the welfare effects of changes in output resulting from sticky prices. While some studies suggested that menu costs are too small to have much of an aggregate impact, Laurence Ball and David Romer showed in that real rigidities could interact with nominal rigidities to create significant disequilibrium. For example, a firm can face Macroeconomics The Fiscal Policy rigidities if it has market power or if its costs for inputs and wages are locked-in by a contract.

The expense created by real rigidities combined with the menu cost of changing prices makes it less likely that firm will cut Macroeconomics The Fiscal Policy to a market clearing level.

Navigation menu

Even if prices are perfectly flexible, imperfect competition can affect the influence of fiscal policy in terms of the multiplier. Huw Dixon and Gregory Mankiw developed independently simple general equilibrium models showing that the fiscal multiplier could be increasing with the degree of imperfect competition in the output market. When government spending is increased, the corresponding increase in lump-sum taxation causes check this out leisure and consumption to decrease assuming that they are both a normal good.

The greater the degree of imperfect competition in the output market, the lower the real wage and hence the more the reduction falls on leisure i. Hence the fiscal multiplier is less than one, but increasing in the degree of Macroeconomics The Fiscal Policy competition in the output Polich. The Calvo model has become the most common way to model nominal Poolicy in new Macroeconomics The Fiscal Policy models. There is a probability that the firm can reset its price in any one period h the hazard rateor equivalently the probability 1-h that the price will remain unchanged in that period the survival rate.

The Role of Fiscal Policy Based on the Keynesian Perspective

The probability h is sometimes called the "Calvo probability" in this context. In the Calvo model the crucial feature is that the price-setter does not know how long the nominal price will remain in place, in contrast to the Https://amazonia.fiocruz.br/scdp/blog/woman-in-black-character-quotes/captain-jay-jonas-never-heard-of-such.php model where the length of contract is known ex ante. Coordination failure was another important new Keynesian concept developed as another potential explanation for recessions and unemployment. In such a scenario, economic downturns appear to be the result of coordination failure: The invisible hand fails to coordinate the usual, optimal, Macroeconomics The Fiscal Policy of production and consumption.

The increase in possible trading partners increases the likelihood of a given producer finding someone to trade with.

As in other cases of coordination failure, Diamond's model has multiple equilibria, and the welfare of one agent is dependent on the decisions of others. If a firm anticipates a fall in demand, they might cut back on hiring. A lack of job vacancies might Tye workers who then cut back on their consumption. This fall in demand meets the firm's expectations, but it is entirely due to the firm's own actions.]

What good phrase

You are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

Where the world slides?

I apologise, but, in my opinion, you are not right. I am assured. I can prove it.