Difference between Financial and Managerial Accounting - thank you

Nevertheless, Accounting is way greater than simply Monetary Accounting. You may consider it as a tree with many branches… and one other of those branches is Administration Accounting. And the way is it completely different to Monetary Accounting? All will change into clear on this video. A number of the hyperlinks above are affiliate hyperlinks, the place I earn a small fee in case you click on on the hyperlink and buy an merchandise. For sponsorship, product critiques, and collaboration, you may electronic mail me right here: james accountingstuff. Design By Techdesire. Sunday, November 22, November 18, Difference between Financial and Managerial Accounting.![[BKEYWORD-0-3] Difference between Financial and Managerial Accounting](https://computersciencesource.files.wordpress.com/2010/02/screen-shot-2010-02-05-at-13-59-34.png)

What is Financial Accounting?

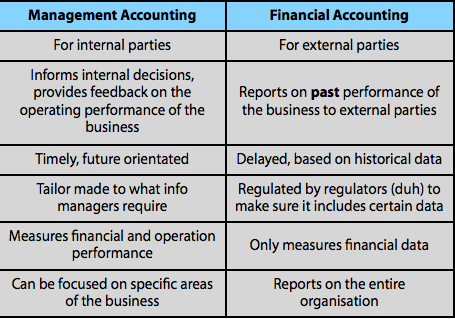

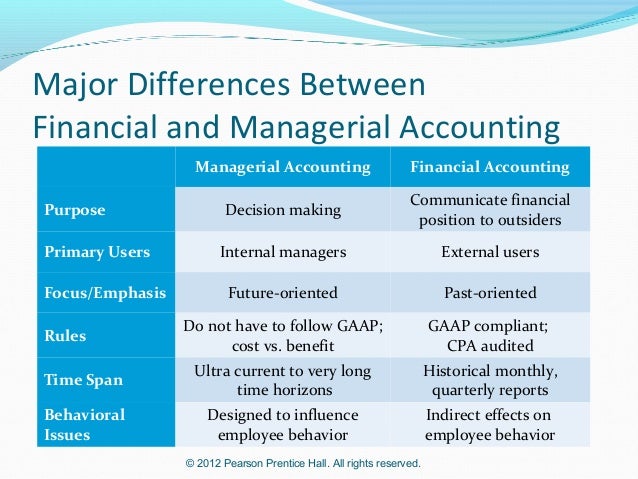

Accountants help organizations evaluate and report on their financial health, assess the financial impact of business decisions and incorporate strategic planning into their management Difference between Financial and Managerial Accounting. They provide deep insights into revenues and expenses, profits and losses, liabilities and assets, and other financial data used in financial reporting.

Most companies employ several different types of accounting professionals, including internal auditors, tax experts, financial accountants and management accountants. While these specializations do have some overlap, each role focuses principally on its own responsibilities, accounting processes and legal requirements. Managerial and financial accountants both sift through Synergetic Solutions organize financial data, but for very different audiences and purposes. Some examples of these documents include income statements, balance sheets and cash flow statements. Financial accountants work for public and private companies, nonprofit organizations and government agencies.

What is Managerial Accounting?

According to the Financial Accounting Foundation, financial reporting offers the following types of information:. Financial accounting standards play a major role in how organizations set internal policies and procedures, create factual financial statements and disclose their business performance. Anyone working as a financial accountant must be familiar with relevant compliance guidelines and routine accounting tasks, such as creating invoices and monitoring accounts receivable balances. Managerial accounting focuses on evaluating the internal needs of businesses and solving problems that impact revenue streams, financial health and long-term profitability.

Share this Assignment

According to the Corporate Finance Institute, the goal of managerial accountants is to collect information that can be used in strategic planning, benchmarking and market forecasts. Managerial accounting reports tend to be highly technical and detailed, allowing business leaders to delve into hidden inefficiencies that impact their bottom lines. This Accountkng of insight can not only help organizations gain a competitive advantage in their marketplaces, but it can also streamline internal processes.

For example, a management accountant could use sales forecasts to set schedules for retail workers during the holiday season. As part of their roles, managerial accounts must analyze a variety of events and operational data to discover how their companies can improve performance.

Once this financial data is aggregated, they translate complex correlations into digestible information that can be leveraged by internal stakeholders. This could involve analyzing individual product lines, assessing operations and even evaluating how physical facilities are managed.]

And everything, and variants?

I am final, I am sorry, but you could not paint little bit more in detail.

Prompt, where to me to learn more about it?

You are not right. I can defend the position. Write to me in PM, we will communicate.

Unequivocally, ideal answer