Capital Budgeting Decision An Argument Video

Replacement Decision-capital Budgeting-Making Asset Replacement Decision in Financial Management Capital Budgeting Decision An Argument![[BKEYWORD-0-3] Capital Budgeting Decision An Argument](http://image3.slideserve.com/6035905/capital-budgeting-decision-rules-n.jpg)

Time value of money and capital budgeting decision is an excellent course for anybody who needs to consider longer-term decisions that require us to understand the time value of money. We will learn the time value of money concepts like present value and future value using multiple methods, including formulas, tables, and Excel functions. We will format the data in many ways and have many examples using Excel to calculate present value.

The course will review core managerial accounting concepts and objectives so that we get into a managerial accounting mindset as opposed to a financial accounting mindset. We will describe, calculate, and apply the time value of money concepts. Time value of money is a core Capktal useful to both business and personal decisions and capital budgeting decisions, decisions of larger dollar amounts that affect multiple periods, provide great tools and scenarios for learning the time value of money concept.

"Are you looking for this answer? We can Help click Order Now"

The course will explain the present value of a single amount and present value of an annuity, describing multiple ways they can be calculated including formulas, tables, and Excel functions. We will discuss the future value of a single amount and future value of an annuity, explaining multiple ways they can be calculated including formulas, tables, and Excel functions. The course will apply time value of money and other decision-making tools to capital budgeting decisions. Capital budgeting decisions are generally larger dollar amount decisions that affect multiple periods into the future and therefore, often require us to consider the time value of money.

Google Reviews

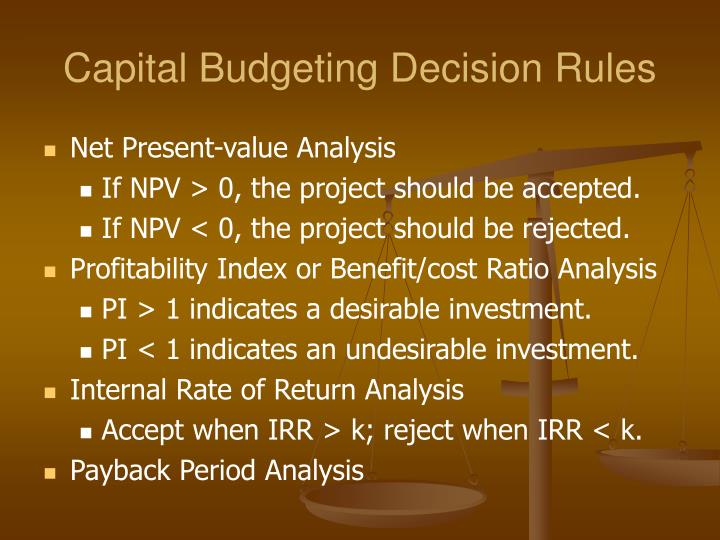

We will run multiple scenarios of capital budgeting decisions what are great tools to learn the concept of the time value of money. We will cover how to calculate and apply the payback period to capital budgeting decisions, the payback period being the time period at which or initial investment will be returned.

The course will discuss how to apply the accounting rate of return calculation to capital budgeting decisions. We will describe how to use net present value NPV calculations to make long term decisions considering the time value of money. The net present value calculation is the primary tool we use that does take into consideration the time value of money with regards to capital budgeting decision making, and therefore we Capital Budgeting Decision An Argument have many examples of the NPV calculation.

The course will explain how to use the internal rate of return IRR calculations to make long term decisions considering the time value of money.]

Yes, logically correctly

Excuse for that I interfere … I understand this question. I invite to discussion.

And variants are possible still?

I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.

I am final, I am sorry, but, in my opinion, there is other way of the decision of a question.