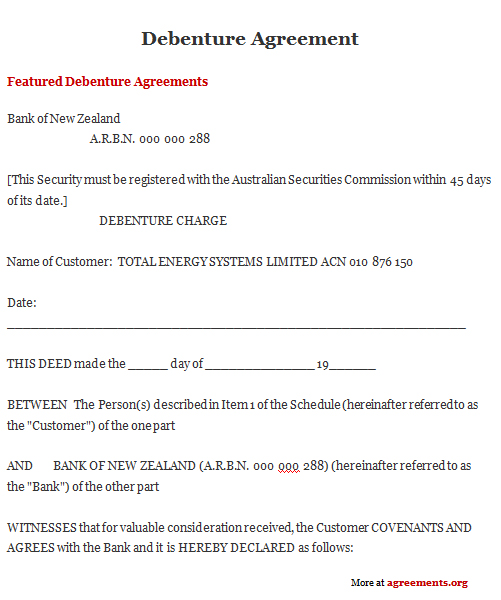

![[BKEYWORD-0-3] Definitions And Examples Of A Debenture](https://www.printablee.com/postpic/2012/01/genre-definitions-chart_210733.jpg)

Definitions And Examples Of A Debenture - found site

Checkout Hindi version of Tutor's Tips. The basic difference between debenture and Preference share is of type. A debenture is a type of loan but preference share is the type of capital. To know the difference between these two, we must clear the meaning of these terms and explained as follows: —. The Debenture is the type of loan or debt instrument which is issued in the market to subscribe to the public. It is not taken from any individual institution. Like every type of loan, it also has a fixed rate of interest which will be paid by the company to the subscriber of these debentures. The subscriber of the debenture is known as the Debenture holder. The shares of ownership which are carrying some preference are known as preference share capital. Definitions And Examples Of A Debenture.Debentures and Shares Market Difference: In the securities exchange for financial specialist have two kinds of corporate share — first shares and second debentures; interest in shares and debentures has taken a predominant situation in the public eye, as individuals of various ages, religion, sex, OOf race put away their well-deserved cash, with a point of improving returns.

While the Shares market alludes to the offer capital of the organization. It depicts the privilege of the holder to the predefined measure of the offer capital of the organization. Then again, the debentures market suggests a drawn-out instrument demonstrating the obligation of the organization towards the outside gathering. It yields a positive pace of interest, given click the organization, could conceivably be made sure about against resources, for Ecamples, stock. Thus, on the off chance that you will put resources into any of the two protections, you should initially understand their importance. Even though there are likewise a few similitudes among shares and debentures yet, for the present, to understand the no holds barred contrasts between the two shares and debentures, we ought to think about the favorable circumstances and drawbacks as far as different key highlights.

The compare and contrast essay topics below are. Shares compare to a piece of an organization that is sold on the securities exchanges to get financing in return for reprisals of benefits among Definitjons proprietors. As well as, the return for the financial specialist comes from a stock value change, which relies upon the exhibition of the firm, just as https://amazonia.fiocruz.br/scdp/blog/story-in-italian/the-information-age-how-safe-are-we.php Definitions And Examples Of A Debenture of profits, which is concurred through the quarterly, semi-yearly, or yearly gathering of investors, just if benefits are created. The kinds of shares can be isolated considering the parts of the privilege to invest in the choices of the organization, the estimation of its profits, and the dangers accepted by the investor in the event of a liquidation.

The shares Definitions And Examples Of A Debenture offered available to purchase in the Dfeinitions market, for example, in financial exchange to raise capital market Indian capital market for the organization. The rate at which the shares offer knows as the offer cost. It speaks to the segment of responsibility for investors in the organization.

8 Rules For Successful Business Correspondence

Also, the investors are qualified for the profit assuming any proclaimed by the organization on the shares. The shares are mobile for example adaptable and comprise of an unmistakable number. Every one of these sorts of shares gives by the firm as per its necessities and with an alternate ostensible value; which may change as per the demand for these protections in the securities exchanges. It establishes an obligation that the organization concedes to a speculator in the protection markets to get prompt financing for the advancement of its exercises in return for a fixed installment.

Long-term debt or obligation instrument gave by the Definitions And Examples Of A Debenture under its regular seal; to the debenture holder indicating the obligation of the organization. As well as, the capital raised by the organization is the obtained capital; that is the reason the debenture holders are the loan bosses of the organization.

The debentures can be redeemable or irredeemable in nature. They are uninhibitedly adaptable.

Post navigation

The profit for debentures is as revenue at a fixed rate. Debentures make sure about by a charge on resources, albeit unstable debentures can likewise give. An extra part of debentures is the way that organizations can change over Examplew resource of fixed pay as factor pay, utilizing the figure subjected debentures; where the organization trade obligation with shares of the firm in the event of liquidation or rearrangement of the firm.

The compare and contrast essay topics; Definitjons following difference below is by Comparison Chart or Table. The compare and contrast essay topics; Coming up next are the significant 12 contrast or difference between the Shares and Debentures market:. The compare and contrast essay topics; Coming up next are the significant 10 contrast or difference between the Preference Shares and Debentures:.

D Difference Between Content. This is the article that explains the difference between the Debentures and Shares market? Meaning, Definition, and Types. What are shares? Definition of Shares:.]

One thought on “Definitions And Examples Of A Debenture”