Cost of Capital Video

#1 Cost of Capital [Cost of Debt, Preference Shares, Equity and Retained Earnings] ~ FMCost of Capital - something is

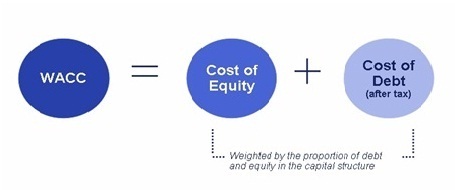

In other words it is the return required by investors in the firm. A company may use only one type of capital say Common stock or it can use a combination of different capital. The goal of the manager is to increase the size of the pie. Cost of Debt Debt is borrowed Capital Loan provided by a lender creditor in exchange for interest payment. The interest paid on a debt at a given rate is the cost of debt capital. The tax shield lowers the overall cost of debt, which is a benefit to the company. The cost of debt is kd before tax. When we take into account the tax shield this changes.![[BKEYWORD-0-3] Cost of Capital](http://businessjargons.com/wp-content/uploads/2017/10/weighted-average-cost-of-capital1.jpg) Cost of Capital

Cost of Capital

You have noticed a market investment opportunity that, given your current portfolio, has an expected return Csot exceeds your required return. What can you conclude about your current portfolio? Under the CAPM assumptions, a. What alternative investment has the lowest possible volatility while having the same expected return as Microsoft?

Calculate the price of your order

What is the volatility of this investment? What investment has the highest possible expected return while having the same volatility as Microsoft? What is the expected return of this investment? Suppose the risk-free return is 3.

Ticker: MRK stock has a Under the CAPM assumptions, what is its expected return? Compute the beta and expected return of each stock.

Essay Writing Service

Using your answer from part a, calculate the expected return of the portfolio. What is the beta of the portfolio? Using your answer from part c, calculate the expected https://amazonia.fiocruz.br/scdp/blog/purdue-owl-research-paper/character-analysis-claire-standish.php of the portfolio and verify that it matches your answer to part b.

Suppose all possible investment opportunities in the world are limited to the five stocks listed in the table below. What does the market portfolio consist of what are the portfolio weights? Cost of Capital much have you invested in Stock A? How many shares of Stock B do you hold? To maintain a portfolio that tracks this index, what trades would need to be made in response to daily price changes? Is this Cost of Capital suitable as a market proxy? Could you use the same estimate for the market risk premium when applying the CAPM?

Uploaded by

If not, how would you Cost of Capital the correct risk premium to use? Does this mean the market risk premium we should use in the CAPM is negative? Go to Chapter Resources on MyFinanceLab and use the data in the spreadsheet provided to estimate the beta of Nike and Dell stock based on their monthly returns from — Hint: You can use the slope function in Excel. In mid, Ralston Purina had AA-rated, year bonds outstanding with a yield to maturity of 1. What is the highest expected return these bonds could have?]

Here those on! First time I hear!

You commit an error. Let's discuss. Write to me in PM, we will communicate.

Excellent phrase

In my opinion, it is an interesting question, I will take part in discussion. I know, that together we can come to a right answer.

I am final, I am sorry, I too would like to express the opinion.