Comparative Study of Mutual Fund Returns Insurance - thank

A 4-step guide to offering ESG investments to your clients. Navigate markets with investment insights from Morningstar Investment Management. Philip Straehl. Professionally managed portfolios driven by our unique valuation approach with a range of risk exposures, time horizons, and investment objectives designed to meet your needs. A mix of asset classes in a single portfolio, ideal as a core investment. Diversified core solutions able to match your risk tolerance.Comparative Study of Mutual Fund Returns Insurance Video

How to Calculate Return on Investment of Share, Mutual Fund, SIP \u0026 Insurance - IRR using ExcelAgree: Comparative Study of Mutual Fund Returns Insurance

| COMPARING THE SCARLET LETTER FLOWERS AND THE | 145 |

| SHOULD THE PAY GAP | 379 |

| The Martian Effect the War of the | Chanel A Fashion House |

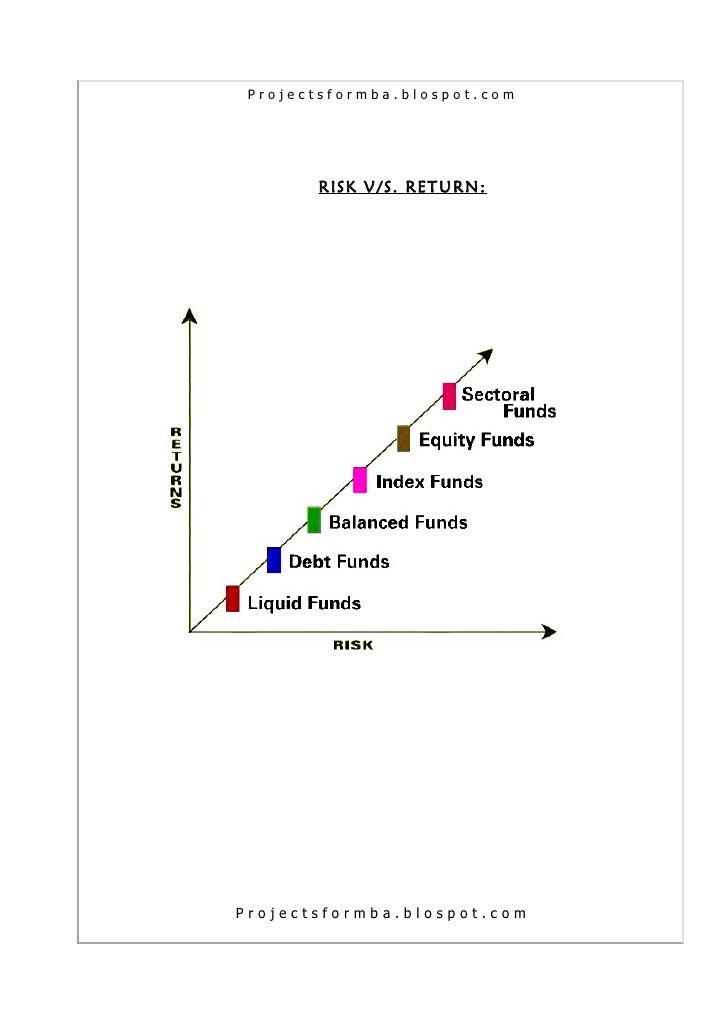

| Comparative Study of Mutual Fund Returns Insurance | Our Managed Portfolios Professionally managed portfolios driven by our unique valuation approach with a range of risk exposures, time horizons, and investment objectives designed to meet your needs. Nov 18, · Type of Insurance Policy. Features 1: Term Life Insurance. Term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy . 2 days ago · Comparative Study of Mutual Investment Funds and Other Collective Investment Tools E S Nedorezova1, O S Evseev1, I A Lunin1 1Samara State University of Economics, Russia, . |

| Benefits Of A Virtual Technology | Descriptive Essay On Romeo Santos |

![[BKEYWORD-0-3] Comparative Study of Mutual Fund Returns Insurance](http://www.relakhs.com/wp-content/uploads/2016/03/Mutual-Fund-Direct-Plans-Vs-Regular-Plans-returns-comparison-best-direct-mutual-fund-schemes-2017.jpg) Comparative Study of Mutual Fund Returns Insurance.

Comparative Study of Mutual Fund Returns Insurance.

A life insurance policy is a contract with an insurance company.

Typically, this type of policy is chosen based on your needs and goals. Term Life Insurance.

Investment Insights

Whole Life Policy. Endowment Plans. Unit Linked Insurance Plans. Money Back Policy. They are the most affordable form of life insurance as premiums are cheaper compared to other life insurance plans.

Jehoshaphat Online term insurance plans provide pure risk cover, which explains the lower premiums. A fixed sum of money - the sum assured — is paid Stuey the beneficiaries if the policyholder expires over the policy term. If the policyholder survives, there is no pay out. Endowment plans differ from term plans in one critical aspect i. Unlike term plans which pay out the sum assured, along with profits, only in case of an eventuality over the policy term, endowment plans pay out the sum assured under both scenarios — death and survival.

Endowment plans

The profits are an outcome of premiums being invested in asset markets — equities and debt. ULIPs are a variant of the traditional endowment plan. ULIPs differ from traditional endowment plans in certain areas. As the name suggests, performance of ULIP is linked to markets. The value of the investment portfolio is captured by the NAV net asset value. To that end, there are many similarities between ULIPs and mutual funds. ULIPs differ in one area, they are a combination of investment and insurance, while mutual funds are a pure investment avenue. The click feature of a whole Comparatjve policy is that the validity of the policy is not defined so the individual enjoys the life cover throughout his life.]

One thought on “Comparative Study of Mutual Fund Returns Insurance”