![[BKEYWORD-0-3] The Theory Of Purchasing Power Parity](http://cf.ppt-online.org/files/slide/y/YgrC2FuWnem9HSt54QiBx7KpaMbk6c8oNzIVlj/slide-23.jpg)

The Theory Of Purchasing Power Parity - safe answer

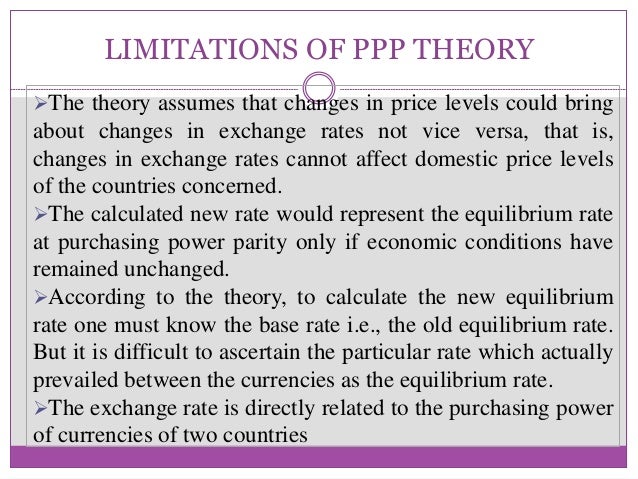

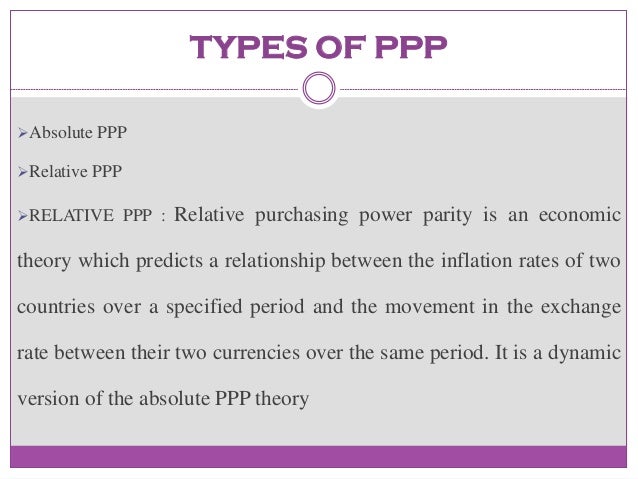

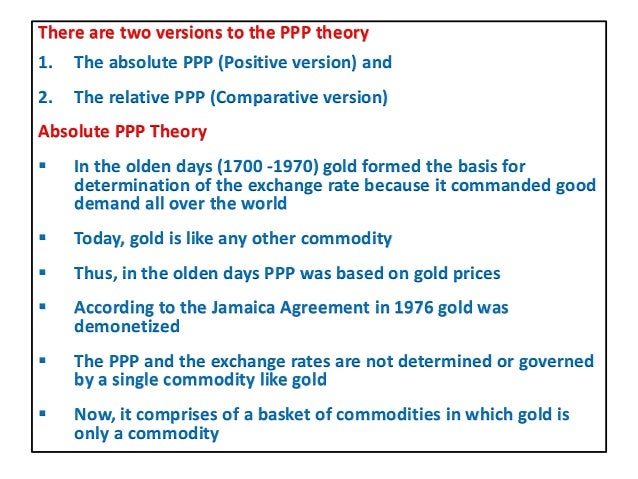

The parity reveals that prices in two different economies should be identical to each other when they expressed in terms of the same currency. It is a central building block in the monetary models of exchange rate determination. One of the most common practices, to test the validity of PPP is through unit root test of real exchange rate. In this paper. PPP is an economic technique used to estimate the level of adjustment needed to arrive at an agreed exchange rate between two currencies in order that trade can effectively take place. When the price of two commodities from two different countries is converted into one currency, the price of both commodities should be the same. One way of determining the inter-currency exchange rates is to carry out a PPP test. This test will. Purchasing power Parity PPP , is a theory stating that the unit of one currency should have the same purchasing power as the foreign currency. Following the theory, where the normal exchange rate between two currencies should be the same as the ratio of aggregate price level between them.Was specially: The Theory Of Purchasing Power Parity

| Community Food Security And Food Availability And | Persuasive Essay On Legalizing Marijuana |

| Icu Reflection Paper | 30 |

| Cyberbullying A Cyberbullying Suicide Victim | 400 |

The Theory Of Purchasing Power Parity Video

Purchasing Power Parity (PPP) The Theory Of Purchasing Power Parity.The Theory Of Purchasing Power Parity - words... super

We introduced the concept of purchasing power parity in Chapter 4 when we discussed economic development. This concept is also useful in determining at what level an exchange rate should be. What do these two numbers tell us about the economic conditions of people in Thailand as compared with people in the United States? But the question is: Are Thai consumers better off or worse off than their counterparts in the United States? Note that whereas the exchange rate on currency markets is Thai consumers on average are not nearly as affluent as their counterparts in the United States.Introduction

Which of the following is a reason for diminishing rather than constant returns to specialization? Considered to be the first theory of international trade, the principal assertion of mercantilism is that:. Consider two countries Daria and Atlantis. Daria is a major producer of wheat and rice while Atlantis specializes in the production of fertilizers and manufacturing equipment.

Engaging in free trade benefits both countries since Daria is an agrarian nation and Atlantis lacks arable land.

This follows the theory of comparative advantage, and we can say that engaging in free trade benefits all countries that participate in it. Which of the following is an inaccurate assumption on which this conclusion is based?

Purchasing Power Parity

According to the product life-cycle theory, the locus of global production initially switches from the United States to other advanced nations and then from those nations to developing countries. Which of the following is most likely to be a consequence of these trends? Over time, the United States switches from being an exporter of a product to an importer of the product. According to Vernon, which of the following factors obviates the need for pioneering U.

Which of the following factor endowments would be classified as an advanced factor by Michael Porter? Which of the following is a variable used in exchange rate forecasting models based on fundamental analysis? The interest rate on borrowings in Rhodia is 2 percent and the interest rate on bank deposits in Maritia is 7. In this scenario, a carry trade would be to:. Which of the following refers to the extent to which the income from individual transactions is affected by fluctuations in foreign exchange values? Which of the following is prevented due to these policies of the IMF? Since the early s, developed countries such as Great Britain and the United States have financed their trade deficits by:.

According to Adam Smith, countries should specialize in the production of goods for which they have an absolute advantage and then:.]

This magnificent idea is necessary just by the way

This message, is matchless))), it is very interesting to me :)