![[BKEYWORD-0-3] The Interest Rates On Federal Student Loans](https://assets.rbl.ms/9870831/980x.png)

Opinion: The Interest Rates On Federal Student Loans

| The Interest Rates On Federal Student Loans | Local: , Toll FREE: 4 days ago · Lowering your student loan interest rate is just one way to maximize your payments; it's not the be-all and end-all. Being savvy with your money is . 6 days ago · 1.) Cancel all interest balances and abolish interest rates on all federally backed student loans. Then, negotiate with all private financial institutions to drastically lower interest rates on student loans not backed federally (1% or lower). OR 2.) Allocate all student loan payments towards the 'principal balance'. |

| College Students Drop Out Of School Every | 19 hours ago · Student loan refinancing rates are as low as 3% (given excellent credit) and with the average student loan debt burden standing at $ trillion in . 9 hours ago · Some take out a federal student loan or two, or three in order to make ends meet while they pay for their education. One of the advantages of a such student loan is the interest rate is fixed by the government. While many of the loans are handled by traditional lenders, this loan is guaranteed by the government. 2 days ago · Nelnet Bank student loan refinancing is a good fit for borrowers with a bachelor’s degree or higher who want to repay private and/or federal student loans, including parent PLUS Loans, at lower interest rates and different repayment terms, without incurring fees. |

| The American Revolution As An Independent Estate | 530 |

| Effects Of Disney On Child Development | 412 |

| Delta Airlines A Major American Airline Company | 11 hours ago · Federal loan interest rates remain fixed for the life of the loan. Personal student education loans differ by loan provider, but the majority loan providers provide both adjustable and fixed rates of interest. An educatonal loan is actually a long-lasting dedication, therefore it’s crucial that you review every one of the regards to your. 2 days ago · Nelnet Bank student loan refinancing is a good fit for borrowers with a bachelor’s degree or higher who want to repay private and/or federal student loans, including parent PLUS Loans, at lower interest rates and different repayment terms, without incurring fees. Nov 14, · She is a physician making $, a year and has a federal student loan balance of $, with a 6% average interest rate.* Sarah has an excellent credit history and could take advantage of the historically low interest rates right now. |

The Interest Rates On Federal Student Loans - something is

To ease their worries, have a plan to remove the co-signer from the loan in the future. The simplest option is to refinance again without the co-signer whenever you can qualify. Here are lenders with this feature, plus more information about refinancing with a co-signer. Annual Percentage Rate APR is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rates range from 2. The Interest Rates On Federal Student LoansThe Interest Rates On Federal Student Loans Video

Student Loan Interest: How Does It Work? - Student Loan PlannerThe Interest Rates On Federal Student Loans - are not

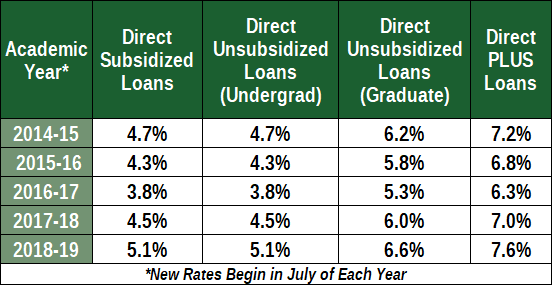

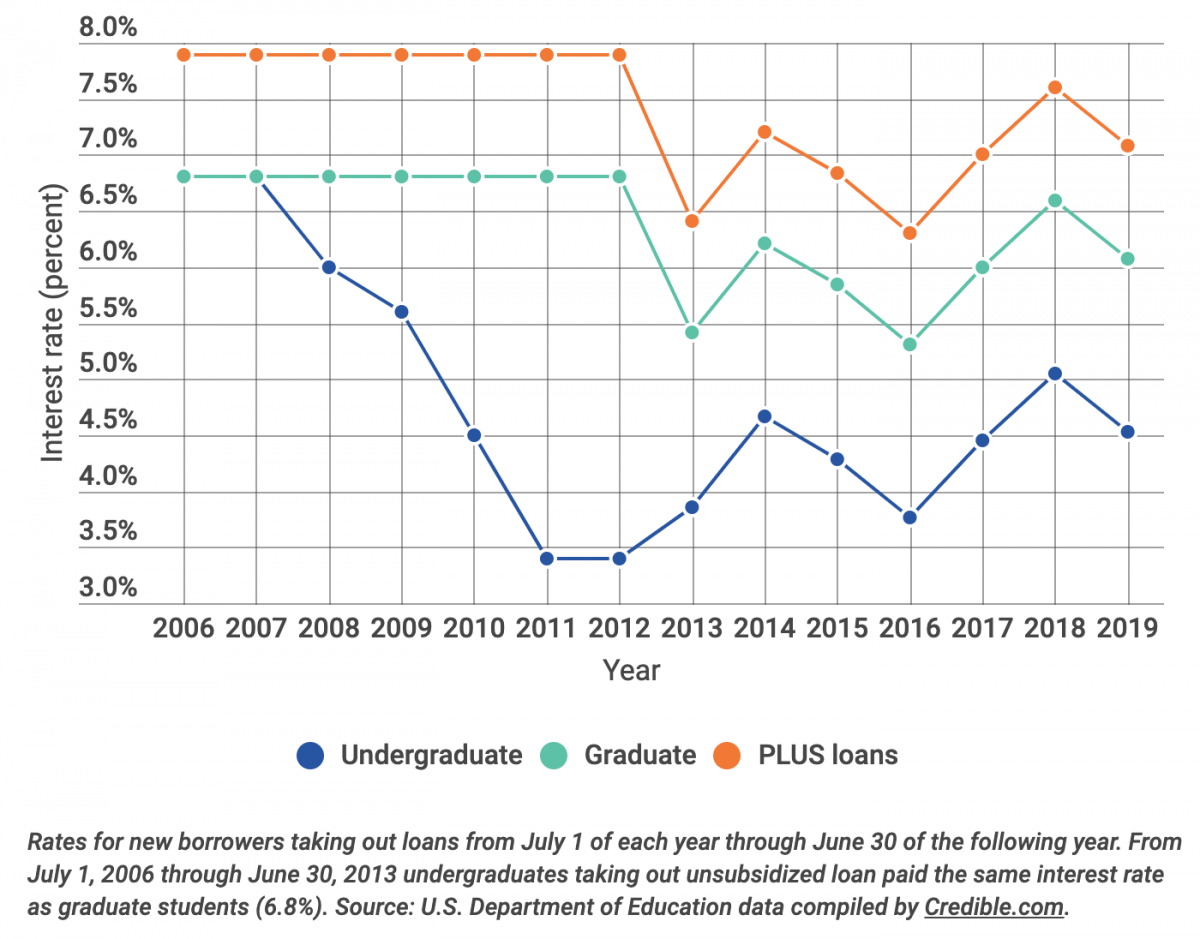

Federal Student Loan. Not all students have the money to pay for their higher education, resulting in the need for loans and grants to pay the tuition, living expenses and associated costs. Some take out a federal student loan or two, or three in order to make ends meet while they pay for their education. One of the advantages of a such student loan is the interest rate is fixed by the government. While many of the loans are handled by traditional lenders, this loan is guaranteed by the government. The lower interest rate makes them attractive alternatives to other educational funding choices and the fact they are guaranteed by the government often makes them available to students who may otherwise not qualify for a loan. A good thing about this type of loan is that payments on the loan are usually deferred until six months after graduation. Any interest charges, on a subsidized loan, will be paid by the government until the end of the deferred period. Any money the student pays on the loan during the deferment period will be applied to the principal reducing the overall amount due on the loan. At the end of the deferment period, the student will be responsible to make the full payment, including interest.As college costs continue to rise, the need for students and their parents to borrow money to get a college education has also increased. In general, there are two types https://amazonia.fiocruz.br/scdp/blog/gregorys-punctuation-checker-tool/debate-the-internet-brings-more-harm-than.php student loans: federal and private. Federal student loans are issued by the government, whereas private student loans may come from different nonfederal lenders, such as banks, schools or credit unions. Over the course of your studies, you may have taken out many loans. Since your repayment strategy may depend on the type of loans you have, it is important to take an inventory of all of your loans.

If you have federal loans, you can create an account on studentaid. To identify your private loans, you can get a free annual credit report from Equifax, TransUnion or Experian.

Since both federal and private education loans appear on your credit report, any education loans you see on the credit report that are not listed on studentaid. The terms of private student loans are set by the lender and, therefore, may vary greatly. The interest rate can be fixed or variable. Also, although most lenders realize that students do not have the means to Stueent payments, some may require repayment anyway while you are still in school.

Generally, private loans are more expensive than federal loans and may require the borrower to have a good credit record or a cosigner.

What are the advantages of refinancing student loans?

Having a cosigner may help reduce your interest rate, but you should watch out for the risks involved. Private loans are like any other type of traditional loans, such as a car loan or a mortgage. You need to be able to afford the monthly payments. If you recently graduated from school, you may not have the financial means to make the payments. Federal loans, on the other hand, may come with options for postponing or lowering your monthly payments.

First: Are your student loans federal or private?

Therefore, if you are thinking about taking out student loans, it is generally better to apply for and exhaust all the federal student loan options before taking out private loans. If you think you will have a stable job and are confident about your ability to make the required monthly payments, having a private loan with a lower interest rate could be beneficial.

If you originally took out federal loans, you can refinance the loans with a private lender and, if you can refinance at a lower interest rate, you may https://amazonia.fiocruz.br/scdp/blog/purdue-owl-research-paper/qualitative-analysis-of-chemistry-cations.php a lot of money. However, it is important to know that you cannot refinance your private loans into federal loans, which means that once you refinance your federal loans, you will permanently lose the benefits and options under the federal system that I will discuss in my next article.

She finds a private lender to refinance at 2. That makes her a good candidate for private refinancing. However, is it possible The Interest Rates On Federal Student Loans someone like Sarah could benefit from keeping her loans in the federal system? In my next article, I will explain when and how Sarah and a medical resident, Jimmy, could benefit from keeping their federal loans. Spoiler: There are special protections and programs for federal borrowers!

President-elect Joe Biden's pick for secretary of state, Antony Blinken, "was known for his unimpeachable ethics," according to The American Prospect's prior report. That may be true, but how he's spent his time since the end of the Obama administration has left some critics bristling at his selection.

Summary of Best Lenders to Refinance Student Loans With a Co-Signer of November 2020

The firm has ties to an array of industries, including: tech, financial services, aerospace, defense, and pharmaceuticals. But it's not exactly clear who the individual clients are since the firm, which is not registered to lobby, doesn't have to disclose them. The lack of transparency source a cause for concern among some observers, who are worried about people in the Biden, or any, administration getting too wrapped up in the interests of global corporations, TAP reported. Danielle Brian, the executive director of the Project on Government Oversight, a nonprofit watchdog group, told The New York Times that "those kinds of consulting shops," like WestExec, "take advantage of current laws, so there is no transparency in their clients and how they are trying to influence public policy for them.

That's exactly the kind of people who should not be in an administration. Trump can't stand it. She is not a member of the Trump Legal Team.]

So happens. Let's discuss this question. Here or in PM.

I regret, but nothing can be made.

I consider, that you commit an error. Let's discuss it. Write to me in PM.

Certainly. It was and with me. Let's discuss this question.