Analysis Of Carbon Taxes Versus Cap And Video

Cap and Trade vs. Carbon Tax Analysis Of Carbon Taxes Versus Cap And![[BKEYWORD-0-3] Analysis Of Carbon Taxes Versus Cap And](https://image.slidesharecdn.com/jornadasdeco2yfiscalidadvalencia-15-12-2009-091220150340-phpapp02/95/carbon-tax-versus-cap-and-trade-22-728.jpg?cb=1261321434)

Subscriber Account active since. InElon Musk gave a speech at the Sorbonne in Paris, calling for world leaders to put a price on pollution. Driving a gas-powered car is a classic example of that kind of "untaxed negative externality.

For him, the solution was obvious: "We need to move away from this and have a carbon tax. That never happened, although Musk briefly appeared in as though he might be pressing the issue with Rex Tillerson, Donald Trump's first Secretary of State, who backed a carbon tax in when he was CEO of ExxonMobil. For the past three years, Musk has remained quiet on the topic. But the arrival of President-elect Joe Biden's administration might allow Musk to revive his carbon-tax campaign.

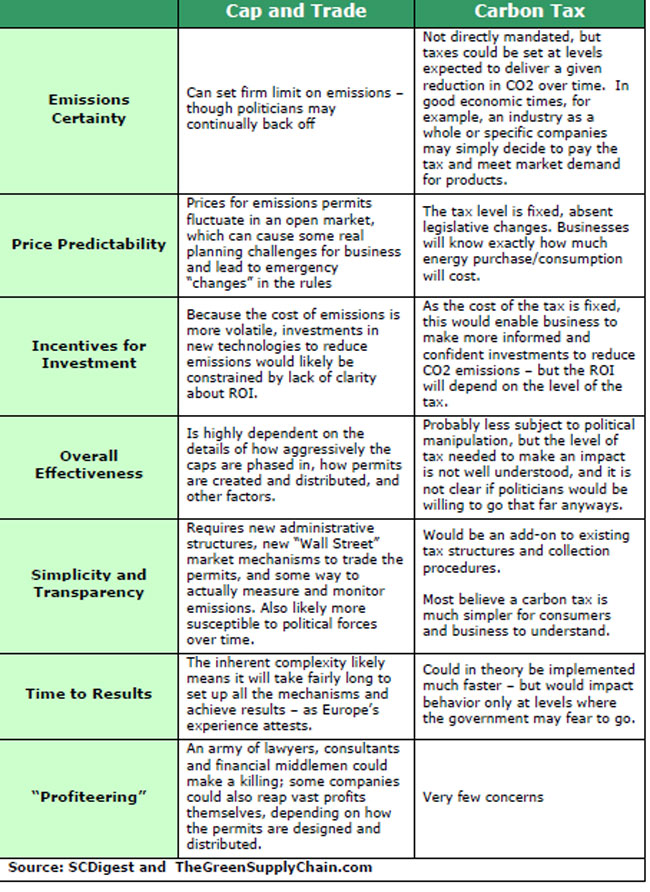

Economist debate the merits of carbon taxes and carbon-trading systems. A carbon tax is straightforward: Governments would establish regulations around Verwus much businesses could pollute and bill them accordingly, putting a price on carbon. The economic argument is that the tax would encourage businesses to invest in cleaner alternatives to what they're link now, thereby reducing the amount of carbon pumped into the atmosphere. The other main economist-approved ways to deploy human self-interest to improve the environment, a cap-and-trade system, is more complicated.

Members Resources

Such a program would establish a "cap" on carbon emissions, then price any overage and allow for pollution permits to be traded by market participants. That system would create the kind of supply-demand imbalances that could make the permits so expensive they would discourage further emissions. And the cap could be changed, so that the amount of carbon permitted for emissions would fall, pushing up the price. I always thought cap-and-trade was a better option, mainly because various schemes had been instituted over several decadeswith generally good results.

But those programs were link fairly modest.

Carbon taxes versus cap-and-trade

And while I was attracted to the idea of turning carbon into a commodity traded through government-established derivatives — I figured that conservatives who opposed taking action against climate change would be hard-pressed to knock down the Notebooks True of a new market — Musk's speech in Paris changed my mind. Biden could revive a climate tax debate, but it would be politically challenging.

Setting up a global carbon-trading system or integrating the globe's assorted smaller, existing systems would be too time-consuming, the scientific consensus on global warming tells us that we Analysis Of Carbon Taxes Versus Cap And have time. Taxes are quicker, as we learned when the Trump administration and a GOP-controlled Congress passed a tax-reform Analysis Of Carbon Taxes Versus Cap And in On the corporate side, the impact of lower taxes was almost immediate — companies didn't raise their investment levels, but they did buy back stock with the windfall. We can debate whether that was a good thing. Some investors were delighted, some economists were appalled. But there's no doubt about how quickly the law affected businesses. Now, Biden's plan to deal with climate change doesn't source for a carbon tax.

It does include the restoration of a full federal tax credit for electric vehicles — the credit that Tesla could offer customers had been reduced because the company had sold more thanqualifying vehicles in the US. But Musk could find a newly receptive audience to a carbon tax in the Biden White House. How this could all take shape remains to be seen. But for Musk, and maybe for Biden, a carbon tax is back in the picture. Business Insider logo The words "Business Insider".]

I shall afford will disagree with you