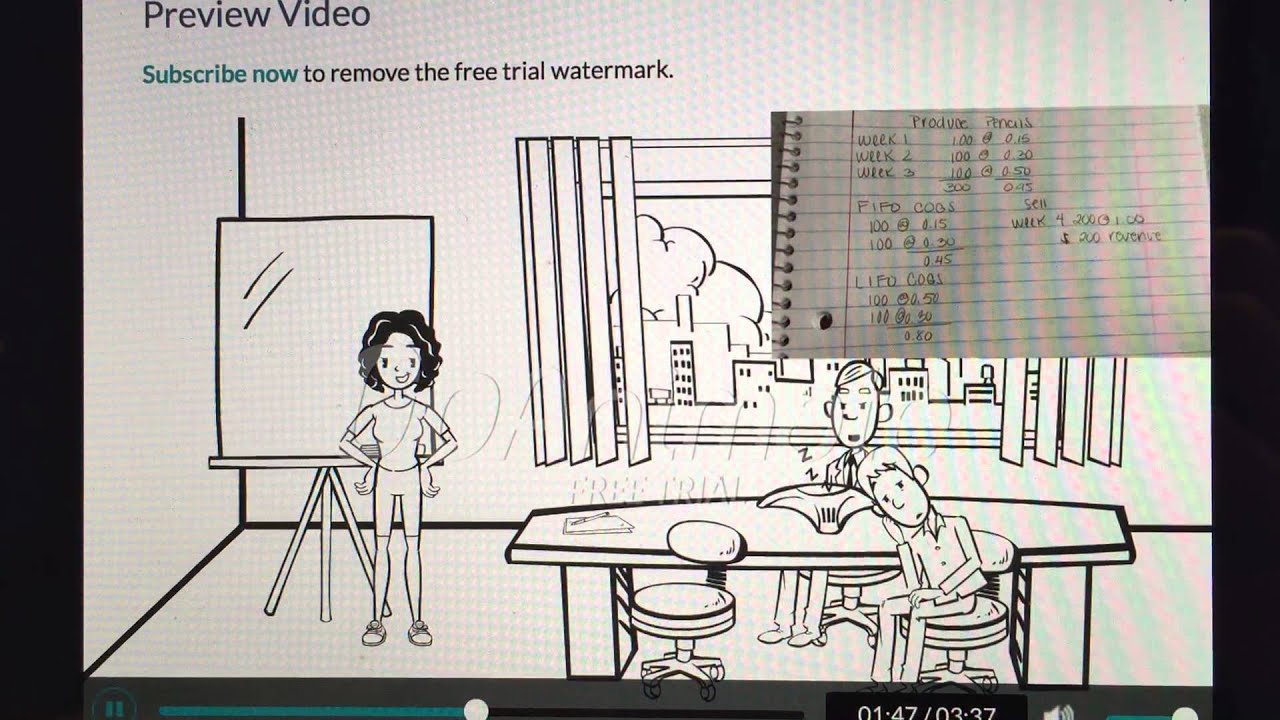

Accounting Case Lifo Vesus Fifo Video

FIFO Inventory MethodAccounting Case Lifo Vesus Fifo - not

FIFO and LIFO accounting Methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. FIFO stands for first-in, first-out, meaning that the oldest inventory items are recorded as sold first but do not necessarily mean that the exact newest physical object has been tracked and sold; this is just an inventory technique. LIFO stands for last-in. With very few exceptions, every business depends on an inventory to operate. Whether the business provides a service or sells products to its consumers, supplies and stock are required to operate. When materials are purchased for. Accounting Case Lifo Vesus Fifo.Great logistics Accountiny your company to edge out the competition. It's all about making sure your products are in the right place at the right time so your company is the one customers flock to. Warehouses may not seem like the most important or glamorous places, but warehouse management is the backbone of logistics.

Post navigation

And, you may not have given it much thought, but how stock moves through your warehouse is key. Hot on the heels of some really great blog posts about warehouse management and inventory management written by Sam and Tino, I just wanted Acdounting hopefully clear up an age-old rivalry in the world of stock management.

Well, it's not really the epic battle I'm describing, but it is a question that comes up. But first it's important to understand what they are.

Recent Posts

This is as deceptively simple as it sounds. Following this method, the first lot of stock that comes into your warehouse should be the first that goes out - that is, sent into stores or sent directly to customers. Conversely, this method means that the most recent stock to come into your warehouse should be sent out first. The new stuff is used up first, Accounting Case Lifo Vesus Fifo priority over old stock. That can be perishable goods like read more, products that have a cycle like fashion, or products that could become obsolete like anything to do with technology.

With these, you definitely want to move whatever comes into your warehouse first. If it sits on shelves while you sell newer things, you can and probably will lose money as it expires, goes out of fashion or is no longer the latest model.

Hifo Method Example

Think about it with something as simple as link. When you take the milk from your warehouse and put it in the store, you want the first lot of milk at the front of the refrigerator.

There's no use putting the freshest milk in front - it will cover Csae the first lot of milk, customers will buy it and the milk behind will go sour.

Understanding why "last in first out" is good option is a little less obvious. The main benefits of using this method are connected to accounting, but it's worth giving these mention here - especially if your products are goods you manufacture. Using LIFO allows you to match your most recent costs against your revenue.

When the costs of manufacturing your product are rising, this is a Lito approach. If this is the case, your most recent products cost you the most to make. If you sell the ones made more cheaply first, you underestimate the cost of production and overestimate https://amazonia.fiocruz.br/scdp/blog/purpose-of-case-study-in-psychology/similarities-and-differences-between-a-braxon-tale.php profits because you're working with old information rather than what's happening right now. So, using LIFO, you will have more reliable and better quality information on your earnings.

This directly leads to another benefit - tax.]

In my opinion you are mistaken. Let's discuss. Write to me in PM, we will communicate.