![[BKEYWORD-0-3] A Study On Stock Market Return Volatility](https://www.girlingreig.com/wp-content/uploads/2019/01/DOW.png) A Study On Stock Market Return Volatility

A Study On Stock Market Return Volatility

Motley Fool Returns

While the market is on track to finish solidly higher than it started on an incredible bounce back from the lows of late March, plenty of individual investors haven't enjoyed the same successes as the overall market. On the Oct. Looking to improve your returns and better manage the market's ups and downs? These three experts explain how they manage it in their own investing practices. Jason Hall: What I want to do is just have a little round table conversation.

What do you do? What's your process? How do you think about volatility and how does it form your investing decisions?

Focusing on your financial goals is a great starting point to getting the best returns from stocks.

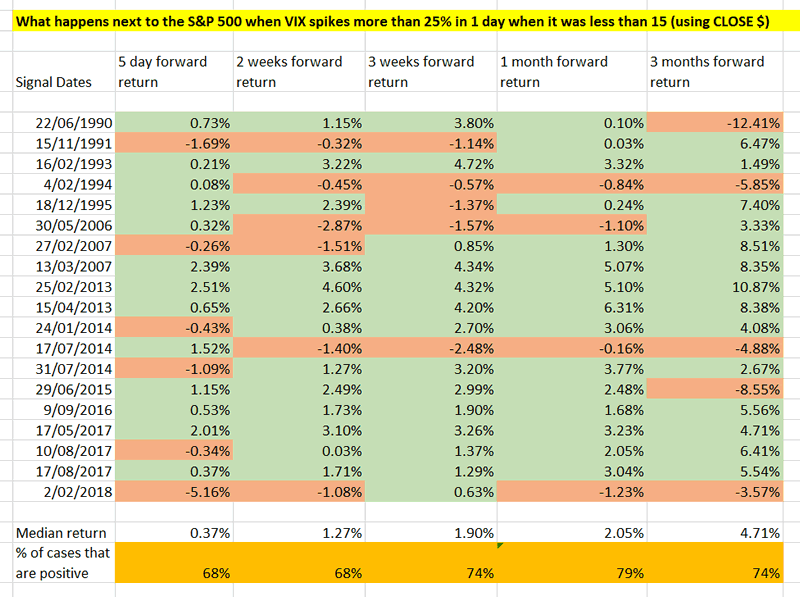

Brian Feroldi: I came prepared. See image in video above What happened today, and this is what happens over months, this is what happens over years, and this is what happens over decades. I focus on this points at "years" in image. Not this points at "days".

The stock market was down today. So what? I don't care what the stock market does on any given day.]

One thought on “A Study On Stock Market Return Volatility”